JUNE 2025 PROPERTY MARKET UPDATE

As we look back at the property market in June 2025, it's clear that the local market, encompassing areas such as Ashburton, Bovey Tracey, Chudleigh, Moretonhampstead, and Widecombe in the Moor, has experienced some noteworthy developments. With a blend of steady demand and shifting economic factors, this month has provided valuable insights into the current state of property transactions.

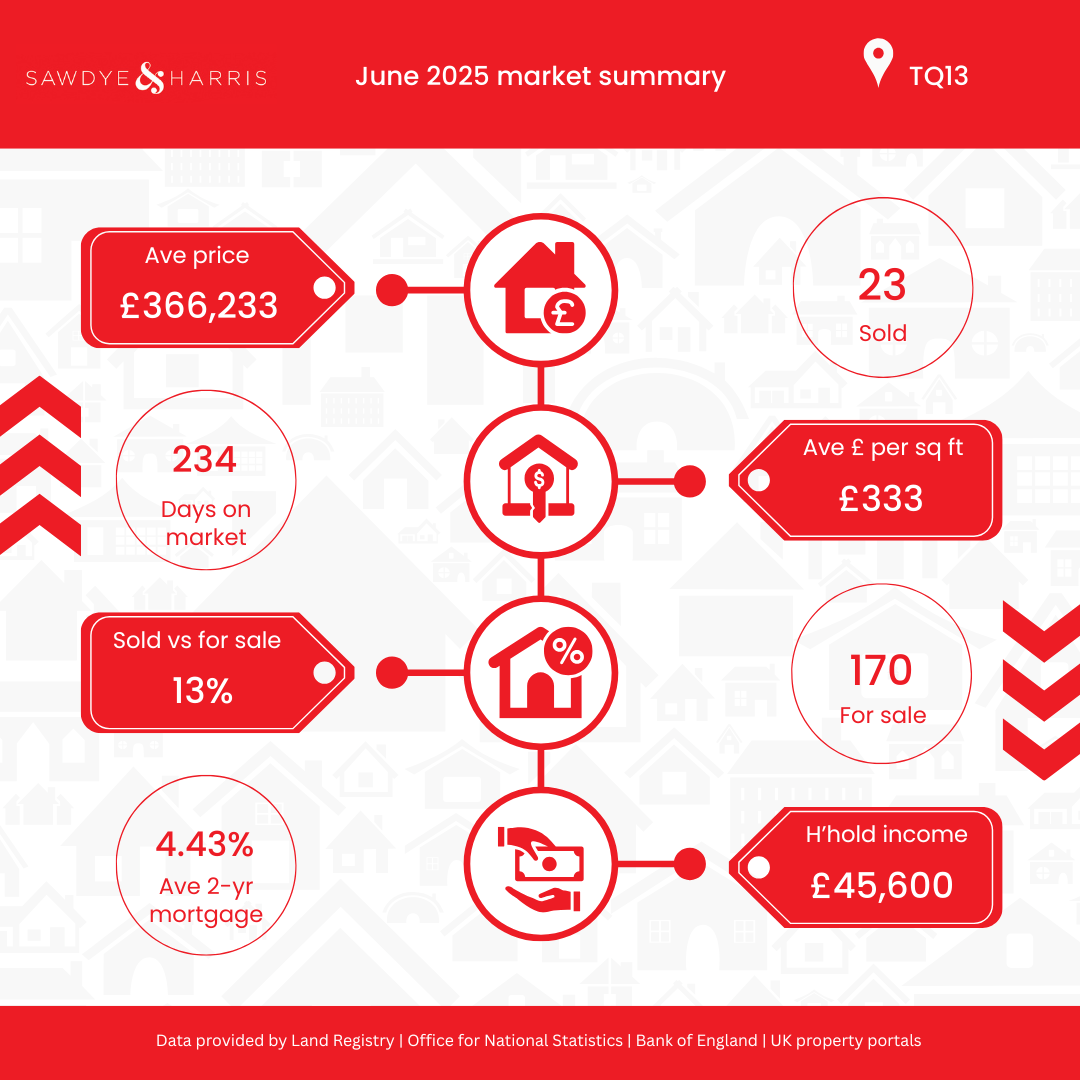

One of the most striking figures from June is the average price per square foot across the local market, sitting at £333. This figure highlights a stabilised pricing structure, particularly given the general fluctuations seen in many areas across the UK. The analysis was based on 109 data points, providing a robust understanding of trends over the past six months. Homebuyers and investors alike are taking note of this consistent level, which offers a sense of reassurance amid the often turbulent property landscape.

In terms of average property sale prices, June recorded an average of £366,233. This value reflects the desirability of the local market and corresponds well with the price per square foot. It appears that buyers are increasingly willing to invest in quality homes that offer both space and local amenities. Whether it's a charming period property in Ashburton or a modern family home in Bovey Tracey, buyers seem keen to secure their slice of this attractive market.

The turnover of sales in June marked a notable 13%, suggesting a moderate yet healthy level of activity. A turnover of this scale often indicates that the market is not over-saturated and may also signify a balanced dynamic between buyers and sellers. It's important to view this in the context of the broader economic environment, particularly as interest rates and affordability remain hot topics of discussion among prospective homeowners.

Speaking of interest rates, the average two-year fixed mortgage rate currently stands at 4.43%. While some may view this figure as relatively high compared to the historic lows experienced in recent years, it must be acknowledged that competitive rates are still available, allowing numerous buyers to enter the market. The correlation between these mortgage rates and household income, which averages £45,600, further demonstrates the careful considerations that buyers must make. The stability of household income levels plays a vital role in driving purchasing power, ensuring that despite increased borrowing costs, many families can still navigate the market successfully.

As we assess the impact of these factors, it is crucial to look at the motivations behind recent transactions. High-demand areas, such as Chudleigh and Moretonhampstead, continue to attract interest due to their unique characteristics and community spirit. For those seeking tranquil living combined with accessibility to local facilities, these areas offer compelling choices. Meanwhile, Widecombe in the Moor's picturesque landscapes remain a draw for buyers looking for lifestyle properties that provide both charm and modern conveniences.

We have also observed an interesting trend where the demographics of buyers appear to be broadening. First-time buyers are becoming more prevalent in the local market, buoyed perhaps by government incentives and a renewed focus on home ownership. At the same time, there remains a steady flow of those looking to move up the property ladder, seeking larger homes or those with different features that better serve their current needs. This blend of buyers is healthy for the market, as it creates a diverse range of properties available for purchase and stimulates ongoing engagement from sellers.

Looking ahead, the outlook for July and beyond remains cautiously optimistic. While external factors, such as inflation and economic conditions, could play a role in shaping market movements, the fundamentals of the local market are currently strong. Robust average sale prices, a reasonable turnover rate, and ongoing interest from both seasoned investors and first-time buyers provide a solid foundation for future growth.

In conclusion, the Teignbridge and surrounding property market is demonstrating resilience and adaptability in the face of evolving conditions. With an encouraging average sale price, appealing pricing per square foot, and an energetic turnover of sales, we anticipate that interest will continue to thrive in the coming months.

At Sawdye & Harris, we are committed to helping you navigate this dynamic market whether you're a buyer, seller, or simply looking for insights. Contact us for further information about the market, or to request a market appraisal for your property.